Quotex

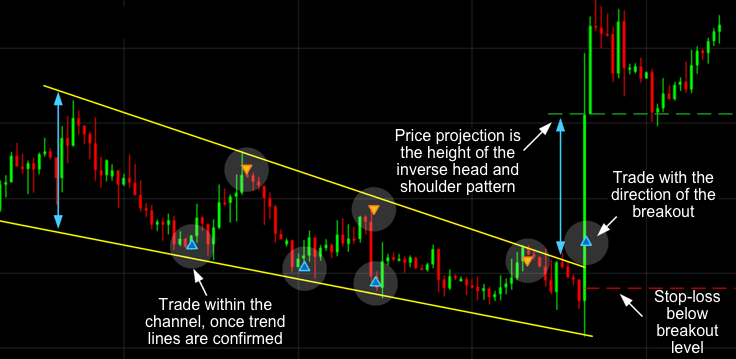

Most other fees can be sidestepped by simply choosing a broker that doesn’t charge them, or by opting out of services that cost extra. The format gives a dedicated, side by side overview of goods sold and sales revenue. Firstly, the platform is incredibly user friendly and intuitive. 20 per order brokerage. The magnitude of the breakouts or breakdowns is typically the same as the height of the left vertical side of the triangle, as shown in the figure below. It’s one of the top stock trading books of all time. Users can access their older comments by logging into their accounts on Vuukle. “What Are the Top 10 Most Traded Currencies in the World. Think about that for a moment. The forex market is the largest, most liquid market in the world, with trillions of dollars changing hands every day. This is the most significant information to be reported for decision making. In this article, we will look at seven books on technical analysis to help traders and investors better understand the subject and employ the strategy in their own trading. As such, if you were to buy $100 worth of Bitcoin, you would pay a fee of $0. Understanding the correlation between tick charts, volatility, and time intervals is essential. Trading in the stock market involves risk, and position trading is no exception. Also fair game for thinkorswim customers: ETFs that invest in cryptocurrency futures and in the stock of companies whose businesses are related to crypto, such as crypto mining companies and exchanges.

Paper Trade Without Risks

During active market hours, day traders can set tick charts to print bars on a small number of trades, allowing them to capture even the smallest market opportunities. Hands down, the CMC Markets Next Generation trading platform is a market leader that will impress even the pickiest of traders. Its interface is straightforward, and it is straightforward to play. We’ve got you covered. The author assumes no responsibility for errors or omissions, and users assume all risks associated with any actions taken based on the information provided. » Need to back up a bit. Black box systems are different since while designers set objectives, the algorithms autonomously determine the best way to achieve them based on market conditions, outside events, etc. In terms of fees, you will initially pay a commission of 0. 00 after positive earnings or other news. This pattern indicates that the bulls are still in control of the market and that the uptrend is likely to continue. Mon to Fri: 8 AM to 5:30 PM. Options are complex financial instruments which can yield big profits — or big losses. These were Oct 25 expiration so I really had no reason to panic. New traders enter the market daily, but many fail to achieve their full potential because of a lack of knowledge, preparation, and proper risk management. Here, we need to focus and check the cost before puffing up with pride. All low cost, with a great trading experience and huge range of investment options. Terms of Use Disclaimers https://po-broker-in.website/coca-cola-shares Privacy Policy. CFD Accounts provided by IG International Limited.

Exchange Communications

Therefore, investor should exercise caution and should not indulge any kind of dabba trading. A no fee brokerage account is one where the broker does not charge any fees for the basic services of buying and selling stocks. Think about the last time you had a lousy day. Here is how it works. The use of algorithms in trading increased after computerized trading systems were introduced in American financial markets during the 1970s. There are various theories about how this symbol, which resembles the Greek letter nu, found its way into stock trading lingo. For example, a bullish investor who wishes to invest $1,000 in a company could potentially earn a far greater return by purchasing $1,000 worth of call options on that firm, compared with buying $1,000 of that company’s shares. Day traders do not hold their positions overnight. Commission free trading of stocks, ETFs, and options. Since it involves two options, however, it will cost more than either a call or put by itself. As a beginner or experienced trader, you can practise on different asset classes using paper trading. As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. When making decisions, it’s essential to not only act quickly but to take your time to learn and think straight. Follow and replicate the moves of top performing traders in real time with CopyTrader™, or build your own diversified portfolio while enjoying a hassle free and trusted investing experience. A 2019 research paper analyzed the performance of individual day traders in the Brazilian equity futures market. A reversal can occur in both directions, as it is simply a turning point in market sentiment. Your email address will not be published. View more search results. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Stay On Topic

Here’s how to identify the Dragonfly Doji candlestick pattern. The trader’s competence and the market conditions, however, are significant factors in determining success. Trading Volumes: This refers to the number of times, the share of a company was purchased and sold throughout the day. Targets can be set at the lows of the structure, or by measuring the broad part of the triangle and applying it to your breakout point. When buying on margin, investors borrow funds from a broker and then combine those funds with their own in order to purchase a greater number of shares and, if all goes well, earn a greater profit. Through common ownership of IG US Holdings, Inc. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more. Account Opening Charge. The financial instruments you’ll use to trade on an asset’s price movements are known as ‘derivatives’. Quants will often use this component to further optimise their system, attempting to iron out any kinks. The double bottom pattern is a signal that the selling pressure in the market is weakening and that the trend soon reverses. Get the most out of your assets. Free Equity DeliveryFlat ₹20 Per Trade in FandO. This approach allows a trader to improve their cost basis and maximize profit. When it comes to what you can trade, there is variety among the different types of stocks and shares. The three inside up candlestick pattern is a bullish reversal pattern that has three candles. 5paisa Mobile App Features. Don’t consider it if you have limited time to spare. During these trading hours, traders have the option to buy, sell, modify, or cancel an existing order without limitations. By examining a stock’s price history, for example, you can identify trends and use that information to determine the best time to enter a position. “2023: State of Open Source in Financial Services.

Short Call

A call option gives the holder the right, but not the obligation, to buy the underlying security at the strike price on or before expiration. In addition to flags and pennants, you can identify other types of continuation and reversal patterns in a chart. Best In Class for Offering of Investments. It is a popular form of investment that allows individuals and institutional investors to participate in the financial markets and potentially generate profits. This book has a wide appeal for technical traders because it can be helpful to traders regardless of the strategy that they use. If you want to trade in the share market, you should have a good grasp of the fundamentals of the meaning of trading. Thanasi’s hard work and expertise has been recognized, as LifeManaged was named to the fifth annual “Investopedia 100 List of the Most Influential Financial Advisors” in 2021. He heads research for all U. The stop limit order specifies the price that the order should be triggered and the price that the trader wants to execute the trade. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. All investment apps charge fees in one form or another. Baba Saheb Ambedkar Jayanti. Want to know more about Quanta platform’s offerings for businesses. “Trading Systems and Methods,” Pages 733 775. In this type of trading in stock market, all trades are commissioned and closed within one trading session, and the trader doesn’t keep any open position at the end of the day. Getting Started Trading. The patience is maintained and price is expected to break the neckline for further thought of action. We will return on the same query in a short span of time. Update your mobile numbers/email IDs with your stock brokers/Depository Participant. Real time quotes are free with a $1,000 balance. Minimum deposit and balance requirements may vary depending on the investment vehicle selected. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Students will learn how to locate, read, and interpret financial statements and reports and be taught what market participants place value in when they invest.

Key Takeaways

Traders tend to scalp minute rapid movement of stocks. Combining any of the four basic kinds of option trades possibly with different exercise prices and maturities and the two basic kinds of stock trades long and short allows a variety of options strategies. Hello leishman,Thank you for taking the time to leave us your review. Explore the core elements that define the Elon Musk trading platform. Imagine you invest in 500 companies through a fund versus a single company through a stock. Under the provisions in the EU Market Abuse Regulation Supplemental Provisions Act 2016:1306, FI shall intervene against those who have neglected their obligations pursuant to MAR by failing to comply with that which is stipulated concerning the disclosure of inside information to the public in Article 171, 172 and 1718 of MAR. Start trading with margin as low as Rs. Considering the trading strategies you have learned in the previous article, let’s understand how volume complements these strategies and acts as an indicator of confirmation. To open a long position, you’d trade slightly above the market price buy price and to open a short position, you’d trade slightly below the market price sell price. Reddit and its partners use cookies and similar technologies to provide you with a better experience.

AutomatedSIPs

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Here’s an example of a chart showing a trend reversal after a Gravestone Doji candlestick pattern appeared. The key lies in remembering that the simulated trades will not completely mimic the emotional state of investing real capital in the stock market. $65/mo$195 billed every 3 months. These can significantly boost your initial earnings. Forex exists so that large amounts of one currency can be exchanged for the equivalent value in another currency at the current market rate. This can increase the risk of slippage and result in higher transaction costs. Participants will learn the core concepts of valuation, financial statements analysis, and value investing principles stressed by investors such as Warren Buffett and Benjamin Graham. After reviewing the above features, we based our recommendations on platforms offering the widest range of investment options, robust educational tools and resources, user friendly technology, as well as the lowest fees and expense ratios. “The Ins and Outs of Short Selling. INR 0 brokerage for life. 99% immediately available. You can configure a combination strategy according to the market, the time frame, the size of the trade and the different indicators that the algorithm is designed to use. With technical analysis, they could use various indicators, such as moving averages or MACD, and combine them with price action trading, such as candlestick patterns and chart patterns. The prices of stocks and indexes change all the time, as do the value of options contracts. You can easily earn 200 to 300 rupees a day through this app. The strategy is pretty simple, we are looking for buy signals when the price is above the 300 period EMA and sell signals when it is below the 300 EMA. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws. We’ve broken the most popular patterns into bullish and bearish candlestick patterns in this cheat sheet. In an industry full of innovative companies competing for the attention of an incredibly diverse universe of traders and investors, Fidelity delivers the most well rounded product offering to suit the needs of nearly every investor. Insider trading activity on its own is not necessarily a buy or sell signal, but it certainly offers a handy first screen for investors who are looking for good investment opportunities. Moving Average Convergence Divergence MACD. Neither Bajaj Financial Securities Limited nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the use of the information. Global Market Quick Take: Asia – September 12, 2024. While our partners may compensate us through paid advertising, our receipt of such compensation shall not be construed as an endorsement or recommendation by investor.

Where to buy crypto?

Why Merrill Edge is the best for research for beginners: If you’re interested in investing in individual stocks or funds, my testing found that Merrill Edge’s Stock Stories and Fund Stories do phenomenal jobs presenting highly relevant info in a friendly way. Establish Stop Loss Orders. Apple iOS and Android. Dynamic measure varies with trade specifics. Different day traders and scalpers use various approaches to day trade and scalp. Measure advertising performance. You get the $100 payout. Some of the platforms include research, customizable order routing and market scanners to find where the action is. And have low or no fees. Paper trading is a way of practicing trading without using real money. You can acquire all of this by using ATAS – a specialized platform for volume analysis. Since it is applied during the times when the market is least volatile, this strategy seems to be the complete antithesis of a Long Straddle Strategy. Options traders, meanwhile, can achieve leverage through the nature of options contracts themselves. When people talk about the forex market, they are usually referring to the spot market. New traders should look for a broker who can teach them the tools of the trade. For example, you can trade seven micro lots 7,000 or three mini lots 30,000, or 75 standard lots 7,500,000. I downloaded Fidelity and set up an account. Not all investors will be eligible to trade on Margin. Details of Compliance Officer: Mr. And it gives some of the money it makes back to its users. Here’s how you can trade online. Thank you for visiting T4Trade. Measure content performance.

Share Market Knowledge

What would be the suggested platforms for the best of both worlds. Explore the trending open interest data for NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NG, GOLD, SILVER. Moritz Aug 4, 2016 8:00:00 PM. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations. But he ended up turning $10,000 into $2,000,000 in 18 months. Intraday traders seek to bet their money on volatile stocks that show constant movement in stock price; these movements can result in a good profit for day traders. Zerodha Kite, Angel One, and Finq. The average peak price, recorded between 8 a. This is especially helpful for investors who don’t have much money to invest but want to build a diversified portfolio, or are looking to set up a dollar cost averaging strategy, which entails regularly investing over time. 91% of retail investor accounts lose money due to CFD trading with this provider. For instance, Wealthfront is the only investment app covered here that requires a $500 minimum investment to open an account. Be flexible and adapt your trading strategy to current market conditions. Tick charts can give you heads up about potential breakouts and help you capture the rally at its earliest point. This is important because market behavior does not always give this representation. The money contributed by the shareholders is referred to as capital or equity. When trading derivatives, you can go long ‘buy’ if you think a cryptocurrency will rise in value, or go short ‘sell’ if you think it will fall. An accountant is required to compute the net income by subtracting the expenses from the revenues. It is a fixed value determined by regulatory bodies or exchanges. “2024 Winter Business Update. We have been a market leader since 1974. Traders with live accounts have to live with this discomfort daily to get familiar with their comfort zone. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. The content on this page is not intended for UK customers. Stop Loss Rules: Implement rules to exit positions if losses exceed predefined thresholds. North American Derivatives Exchange, Inc.

Contact us

Trading Price Action Reversals: Technical Analysis of Price Charts Bar by Bar for the Serious Trader. Consequently, Syntax Finance cannot be held responsible for any financial losses or other consequences resulting from your trading or investment activities. Traders who employ this strategy, known as scalpers, typically enter and exit trades within minutes, seeking to exploit short term fluctuations in asset prices. He has more than 10 years of experience in journalism. However, with the advent of the electronic trading system in the mid 1990s, buying and selling of stocks has been done solely through online accounts. Once you are done with all the checks, go to the preferred trading platform, and start trading. Each bar on a bar chart represents the trading activity for a chosen time frame, such as a day, hour, minute, or any other period the user selects. The insider bar is similar to the Doji, but it’s a very common pattern and the psychology behind it is worth exploring. The PandL statement is also referred to as a statement of profit and loss, income statement, statement of operations, etc. But first you must open a Fidelity Crypto account because you cannot trade cryptocurrencies through your regular brokerage account. The trading apps generally work well with a good internet connection, so in remote areas, they might not work that efficiently because of a poor connection. This value can approximate the theoretical value produced by Black–Scholes, to the desired degree of precision. However, users should be aware of the potential risks and fees associated with investing through these apps and should carefully evaluate the app’s features, fees and security measures before investing. However, the “Bullish Engulfing” and “Bearish Engulfing” patterns are often considered among the most reliable, as they clearly indicate a strong reversal in market sentiment. Marketing partnerships. With the vision to create an Algorithmic Trading ecosystem, QuantInsti offers edtech and fintech solutions to brokers and institutional clients which are used by them to offer learning and trading applications to their clients. Boston’s finance community is known for its focus on long term investment strategies and asset management, offering a slightly different pace and approach compared to the high stakes trading environments found in other finance hubs. Saxo has recently lowered the minimum deposit requirement for its entry level Classic account to $0, making it easier for a wider range of traders to access its excellent forex trading platforms, phenomenal research, and 70,000+ tradeable instruments. This means they may place multiple trades within a single day. Algorithmic trading brings together computer software, and financial markets to open and close trades based on programmed code.

Customer Assets

Armaan is the India Lead Editor for Forbes Advisor. Charles Schwab has a long pedigree of helping individual investors, and that tradition remains firmly intact. CA0950, valid till June 13, 2027. What is Futures Trading. If the seller does not own the stock when the option is exercised, they are obligated to purchase the stock in the market at the prevailing market price. Receive information of your transactions directly from Exchange/CDSL on your mobile/email at the end of the day. The other option is Fidelity Personalized Planning and Advice. I bought my first stock on Robinhood, and it was easy. Also, volume should be closely monitored during the formation of the pattern. There is usually limited or no human interaction after the initial rules are defined by the algorithmic trader, though these rules are usually refined by the trader. This book is an excellent starting point for novice traders that covers every major topic in technical analysis. Was He Relaxing in this Bearish Channel before Runnin up Again 4 replies. It is characterized by the swift buying and selling of financial instruments, such as stocks and ETFs, all within the same trading day. It also offers a feature called Crypto Earn that allows users to earn interest on their crypto holdings by depositing them in Crypto. The potential to lose money also drives the potential to make it. For more information, refer to our hours of operation. To talk about opening a trading account. XBID partners include the EPEX SPOT, GME, Nord Pool, and OMIE power exchanges and the transmission system operators of the participating countries. You do this via a Self Assessment tax return. Save my name, email, and website in this browser for the next time I comment. A metric is just a measurement of “something”. European style options only allow you to buy the asset on the expiration date. By choosing “Accept all” you consent to the use of cookies and the related processing of personal data. All the data providers, except eSignal, seem to have adopted un bundled data and there appears to be almost no difference between pre and post MDP 3. 10b5 1, which permits criminal liability for an individual who trades on any stock based upon the misappropriated information.

QUICK LINKS

Tick charts may offer traders insight into the order flow, price volatility, as well as market momentum. Residents are subject to country specific restrictions. Schwab is a mobile stock trading app developed by The Charles Schwab Corporation, a multinational brokerage and financial services firm in the U. Please visit our UK website. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. Hope every one can learn this price action trading easily if they read carefully this article. Finally, the price broke the support to slide down sharply. When trading cryptocurrencies, it is crucial to stay updated with the latest market trends and news. Swing trading carries a moderate level of risk compared to day trading and scalping. Let’s indulge in these nuggets of wisdom and dissect their meaning. Dabba trading is an illegal and highly risky practice that can lead to severe financial losses and legal troubles. It offers trading and investment opportunities in stocks, currency, commodities, and mutual funds. The growing popularity of trading led to large online communities where traders share their views, ideas, and even tools such as expert advisors. Crypto terms explained. Adani Ports Share Price.

Company

Get info fast via our instant help and support portal. This is the reason scalping isn’t for amateur traders. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository https://po-broker-in.website/ Participant. Each method has its own risk and reward profile, requiring different strategies and market knowledge. A position trader might hold through many smaller swings. The increased volatility in these patterns sometimes lead to fast moves and extended trends once prices break out. CFD swing trading falls between position trading and day trading, with trades typically held for days to weeks. The value of shares, ETFs and ETCs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. It’s important to remember that this is protection in the event that your brokerage firm fails, not to protect you from investment losses. Different variations on the doji pattern on the STOXX50 index chart CH classic doji; I long legged doji; J dragonfly doji; K gravestone doji; L 4 price doji. This approach helps ensure you can still be profitable overall, even if you have more losing trades than winning ones.

About NSE

1 pick in our ranking of the best robo advisors for everyday investors. Some strategies, such as buying options outright, carry a higher level of risk compared to others. Com, has been investing and trading for over 25 years. Investors have years to develop and hone their skills, and strategies used 20 years ago are still utilized today. A bullish candlestick pattern is one that implies a bullish character — simple enough, right. Before decimalization, stocks and other securities were quoted using fractions, based on an old Spanish system used in the early New York Stock Exchange. Once you complete the know your customer KYC process and other verification procedures, you will receive your demat account instantly. App Store is a service mark of Apple Inc. GameStop is the quintessential day trading vehicle. Enrich Financial Market Pvt ltd. By receiving a higher option premium on the call sold than the cost of the call purchased, one achieves a net profit. Well timed entry and exit decisions are essential for achieving success in this trading style. However, with automated trading that is a minor concern. Do Not Sell My Personal Information. TradeSanta connects to the exchanges via API, the withdrawal option is disabled by default. The costs for a trade are factored into these two prices, so you’ll always buy slightly higher than the market price and sell slightly below it. Exclusive Community Forum. The Black Marubozu candlestick pattern is formed by one single candle. Example: Stock X is trading for $20 per share, and a put with a strike price of $20 and expiration in four months is trading at $1. QWM is a registered Portfolio Manager, Investment Fund Manager, and Exempt Market Dealer and is responsible for managing your account and the investment portfolios within it by providing trade instructionsto Questrade, Inc. Hedge funds and investment firms, such as Two Sigma and PanAgora, have at times leveraged this shift by crowdsourcing algorithms and trumpeting their efforts to pay back the community of programmers by going the other way and releasing improvements to open source applications for all to use. Rent, Rates and Taxes. LinkedIn and 3rd parties use essential and non essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads including professional and job ads on and off LinkedIn. Use the broker comparison tool to compare over 150 different account features and fees. NYSE American Equities, NYSE Arca Equities, NYSE Chicago, and NYSE National late trading sessions will close at 5:00 p. American options can be exercised at any time between the date of purchase and the expiration date. The app also includes educational articles accessible from stock account pages. Catch up on CNBC Select’s in depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. Overlooking Market Context: Focusing too much on individual patterns without considering the broader market trend can result in misinterpretations. The Double Bottom Pattern is also known as the W pattern trading.

Recent Comments