222,014,802USERSTRUST US

No personal pension SIPP. Each bar on a bar chart represents the trading activity for a chosen time frame, such as a day, hour, minute, or any other period the user selects. In any case, the premium is income to the issuer, and normally a capital loss to the option holder. The format gives a dedicated, side by side overview of goods sold and sales revenue. Fidelity retirement and 529 accounts allow you to invest for your and your children’s futures. Since the securities collateralize your loan, any price declines reduce www.pocketoptiono.site your equity and potentially trigger a margin call. US Cash Indexes since 1998 from tick to daily resolution bars on NDX, SPX, and VIX. Really loved the podcast and Thanks to the customer success team for navigating me through the App. The fluctuations in the value of any stock are recorded all through the trading day and compiled after the session for easy reference. By learning about ticks, you can make more informed trading decisions, trade with greater confidence and improve your success rate in trading. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. Comes with TFC feature. Based brokerages on StockBrokers. Follow us on Facebook, X, YouTube, Instagram and WhatsApp to never miss an update from Fortune India.

Who Trades on It?

We’ve picked 7 best methods that you can use when preparing for scalping. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. A contract with low gamma, a reading near 0, won’t be very responsive to price changes. Think of it as a “floor” where demand for the assets increases. It should be available as a build in into the system or should have a provision to easily integrate from alternate sources. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. Fidelity’s mobile experience is cleanly designed, bug free and delivers a phenomenal experience for investors. After all – and much like gold, Bitcoin and many other cryptos do not yield any income. Once you’ve found what you’re going to trade, then it’s time to execute the trade. Unparalleled range of investable foreign and domestic assets. We collect data directly from providers through detailed questionnaires, and conduct first hand testing and observation through provider demonstrations. These encompass a variety of trading strategies, some of which are based on formulas and results from mathematical finance, and often rely on specialized software. Traders may enter positions in anticipation of a trend reversal, aiming to catch the new trend from its early stages.

What is a Trading Account?

01% default options offered by some competitors. IG Academy has a wealth of information to get you acquainted with the markets and learn the skills needed for boosting your chances of trading forex successfully. Use profiles to select personalised advertising. Typically, trusted exchanges enjoy the support of a loyal user base, and see their hard work reflected back in the form of top rankings, 5 star ratings, and award recognition. Support and Resistance Levels. Use profiles to select personalised advertising. The double bottom is seen as establishing a strong support level, and it’s a good place to consider adding stop loss orders or mental stops as a subsequent break below that level would show that immediate support failed and the stock may have further to fall. My real problem with this app is they are missing a lot of socks especially penny stocks they don’t have any as they don’t support it l and I have contacted the team before and no response. The corrective phase is BC and it posed overhead resistance to an advance. Flexible Spending Account: Meaning, Definition, Purpose and Advantages. If the price movement turned against you by $10, then you’d lose 100% of your initial deposit. Scalping relies on the idea of lower exposure risk, since the actual time in the market on each trade is quite small, lessening the risk of an adverse event causing a big move. Cryptocurrencies are digital currencies that function similarly to forex but are not regulated by banks or governments. A seamless, experience. So, if GBP/USD moves from $1. Some provinces provide for disclosure to take place earlier, within 10 days of the persons’s becoming an insider or making a trade. If a stock finishes near its high, the indicator gives volume more weight than if it closes near the midpoint of its range.

Mistakes To Avoid When Selecting a Forex Trading App in India

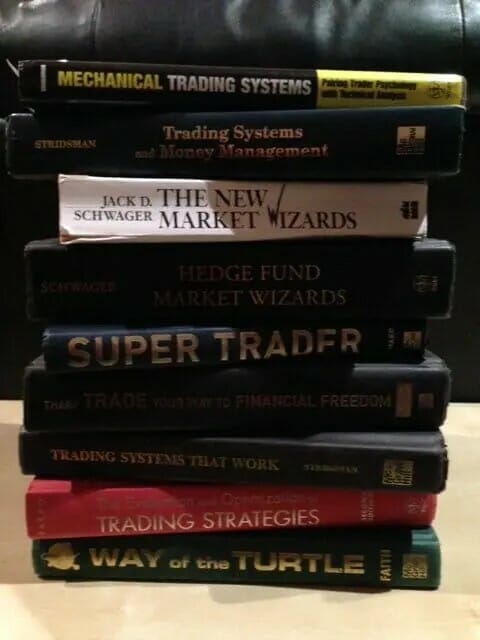

Bajaj Financial Securities Limited is only a distributor. 75, so any drop in the underlying down to this point will be offset by the premium received from the option position, thus offering limited downside protection. Utility for working with colors. Many serious traders use TradeStation because of its proprietary programming language, which allows automated trading. Com mobile, MetaTrader mobile. This window opens from 5:00 pm and closes at 9:00 or 9:30 pm. INR 0 on equity delivery. The two lows and the central high of the W pattern can be represented by distinct bars, highlighting the potential reversal points within the downtrend. F Other current assets. A bearish pennant is a pattern that indicates a downward trend in prices. Don’t have an Account. The VWAP provides an average price certain security trades at during a single trading day. Running a strategy optimization and then picking the best values right away, is very prone to curve fitting. For instance, in futures trading, the tick value is calculated by multiplying the tick size by the contract size. Investment Biker: Around the World with Jim Rogers’ explores the world of finance in a completely unique way. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who “add liquidity” by placing limit orders that create “market making” in a security. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. This, in turn, will help you navigate the markets better and with more confidence. In forex, margin requirements vary as a percentage of the notional amount. Customize your settings, including regional currency display, routing, and language preferences. With the knowledge gained from this comprehensive guide, you are now equipped to master the M trading pattern. The neckline connects the lows between the peaks. If you want to improve your knowledge about trading options, these are the best books on options trading available. Flat Brokerage Rates for all exchangeand all segments. Traders often use this breakout as a signal to enter a long position, with a stop loss set below the horizontal support level. The Options Industry Council.

Sep 12, 2023

Buying a straddle lets you capitalize on future volatility but without having to take a bet whether the move will be to the upside or downside—either direction will profit. Enjoy the convenience of virtual learning without compromising on the quality of interaction. Intraday trading requires a high level of discipline to navigate the fast paced stock market successfully. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. An option that conveys to the holder the right to buy at a specified price is referred to as a call, while one that conveys the right to sell at a specified price is known as a put. It has survived on the market for a long time, and has been given many new features over the years. These indicators help identify potential entry and exit points and provide insights into the market’s overall direction. Call +44 20 7633 5430, or email sales. In addition, options do not give traders the right to earn dividends or ownership of the asset, whereas equity trading allows for both of these. Complete all deposits and withdrawals within 1 business day. Share now on socials. Commodity market timing isn’t just about knowing when to trade; it’s about connecting with the global market, tracking economic indicators, and staying informed about geopolitical events. Electronic trading platforms had already been in use since the 1970s, but they were only used by brokers and financial advisors. First, open a free demo account and trade using fake money to learn how the trading platform software works. Stock trading apps are generally safe to use. Click here to learn more about how we test. But there are important differences in the rules for options and futures contracts, and in the risks they pose to investors. Capped commission structure for options. Blain created the original scoring rubric for StockBrokers. Read more at consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. With impressive charting software, a large array of tools to use, and plenty of features to help you analyze trends, TradingView has enough to keep even the most demanding trader satisfied. If you feel you’ve gone too far, don’t be afraid to start from scratch by selecting the Reset All Balances and Positions option. IG Groups total shares. Stock transaction tax, trade fees, services tax, etc. The trading sessions on Saturday will involve an intraday switchover from the primary site PR to the disaster recovery DR site, according to the exchange.

New to credit loans

It was really a nice lesson for me and am glad I came across this page otherwise I would have lost everything I worked for. If that sounds far fetched to you, you’re not alone. Additionally, market conditions can change quickly, so traders must reconstruct their strategies accordingly. It’s a cross between a long calendar spread with puts and a short put spread. Measuring results is key. For example, if the firm provided day trading training to you before opening your account, it could designate you as a pattern day trader. Learn more about how we review online brokers. You can also spread the payments over 12 months. Another major consideration is how much time you want to put into stock trading. The best forex hedging strategies. “The Profitability of Day Trading: An Empirical Study Using High Quality Data. Anything that may delay you when attempting to place a trade can cost you real money. Investopedia launched in 1999, and has been helping readers find the best online brokerage accounts since 2019. This strategic use of leverage highlights its importance in implementing risk management strategies. Vega indicates the amount an option’s price changes given a 1% change in implied volatility. Therefore, only experienced scalpers make money. In addition to low fees and a strong regulatory standing, the eToro crypto trading app offers several other features that are worth a quick mention. You can also sign up for a wide range of account types, including IRAs and custodial accounts for children, in addition to more typical taxable accounts. A single trading interface for 27 Spot and 9 Futures exchanges, featuring charting tools and technical indicators, Trailing orders, Stop Loss + Take Profit combos, conditional orders that won’t freeze your balance, TradingView webhooks, order execution alerts, and much more. If you’re new to investing, starting with a low cost index fund could be a good option.

FREE Offers

Mortgage borrowers have long had the option to repay the loan early, which corresponds to a callable bond option. And I liked the free stock I got for opening an account; it was from a fairly well known company that I was curious about anyway. You can practise using these trading styles in a risk free environment by opening an IG demo account. 10 Tips For Mastering the Transition From a Demo to a Funded Trading Account. We offer over 80 international indices, so you can trade any of the world’s the biggest and most popular indices with us. It is important to understand that there are risks, costs, and trade offs along with the potential benefits offered by any options strategy. If there is an upward trend in an asset, where its price might be consistently growing in price, then traders would take a long position and buy it. Remember trade types involving the latter are still evolving in the U. Install and sign up on the Appreciate mobile app. David Joseph, head of DailyFX USA. Bajaj Financial Securities Limited or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. I don’t understand what the purpose of switching on two factor authentication or Face ID is for when during some updates it decides to reboot your settings and then you personally have to realise this and go to settings and switch it back on again. In simple words, the Bollinger band looks like a cloud, and the stock is supposed to trade within this cloud. Rowe Price, tastytrade, TradeStation, TradeZero, Vanguard, Webull, Wellstrade. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. Before now, I didn’t have a thorough understanding of most of the candlestick patterns that you discussed, but now I have understood thoroughly, and I believe this will have a very positive effect on my trading. No, the Federal Deposit Insurance Corporation does not insure brokerage accounts. XBID partners include the EPEX SPOT, GME, Nord Pool, and OMIE power exchanges and the transmission system operators of the participating countries. Many of the expense ratios are extremely competitive, some as low as 0. Low spreads and zero commission depend on product and account type.

Share Market

Click Here to learn how to enable JavaScript. You can have multiple charts on the screen at once and layer your workspace with tabs. Find out why people choose these two alternatives to traditional trading. Several brokers also allow users to paper trade before funding an account, allowing you to learn the platform, sample the available assets, and test out the trading experience without risking real capital. Any articles, daily news, analysis, and/or other information contained in the blog should not be relied upon for investment purposes. You can practice with stocks, options, and futures in both real time or historical simulations. Please check and install the app. To determine the plan that works best for you, you’ll need to spend some time looking at Interactive Brokers’ pricing, think about how much and how often you’ll be trading and run your own numbers. Keep in mind the following tips when trying to narrow down your choices. Let’s set up a 30 minute video call to discuss your company’s requirements. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. It is also known as micro trading. Using it on mobile may be stress for some people so if you can’t do whatever on your phone switch to the desktop or laptop and you should be fine. This article will guide you through the process of downloading a color trading app, explain its features, and provide insights into how you can get the most out of this innovative technology. Because the value of the EUR has gone up, you make a $200 profit. As mentioned before, Interactive Brokers is the only one of the two best brokers to provide you with access to U. As such, if this is your first time investing in a cryptocurrency online, Kraken is a good option and alternative to Coinbase. Options contracts have been known for decades. Excellent features to help you trade easily in any segment you like.

Personal

To sum up, the strategic application of these indicators, coupled with a versatile trading strategy, can result in improved decision making and potentially superior trading results in the dynamic options market. Such reversals happen rarely and few and far between. Don’t take our word for it. Analyze premium decay for call and put options on NSE, BSE, and MCX indices and commodities like NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NG, GOLD, S. IronFX was founded in 2010 and is regulated by the FCA, CySEC, and FSCA with one unregulated entity based in Bermuda. A stock can go down or up on overnight news, inflicting a bigger trading loss on the owners of shares. While the aforementioned approach might involve executing multiple trades per week, day trading might involve making several different trades in a single day. Bearish continuation patterns suggest that the existing downtrend bearish will continue. To learn more about our rating and review methodology and editorial process, check out our guide on how Forbes Advisor rates investing products. The Hammer candlestick pattern is formed by one single candle. During a downtrend, focus on taking short positions. You can access our Cookie Policy here. However, it does take a significant amount of experience and skills to make forex trading work, and a lot of people do lose money through carelessness, lack of planning, or just plain bad luck. Less liquid markets trading lower volumes are not ideal for this approach because they do not have the depth of order book to sustain it. In swing trading, Fibonacci retracement can help identify retracement levels on a price chart. Position traders tend to use fundamental analysis to evaluate potential price trends within the markets, but also take into considerations other factors such as market trends and historical patterns. With it, you can create price alerts, view stock watch lists, and examine charts with custom indicators.

Recent Comments