NSE, BSE Special Trading Session On Saturday: Here’s All You Need To Know

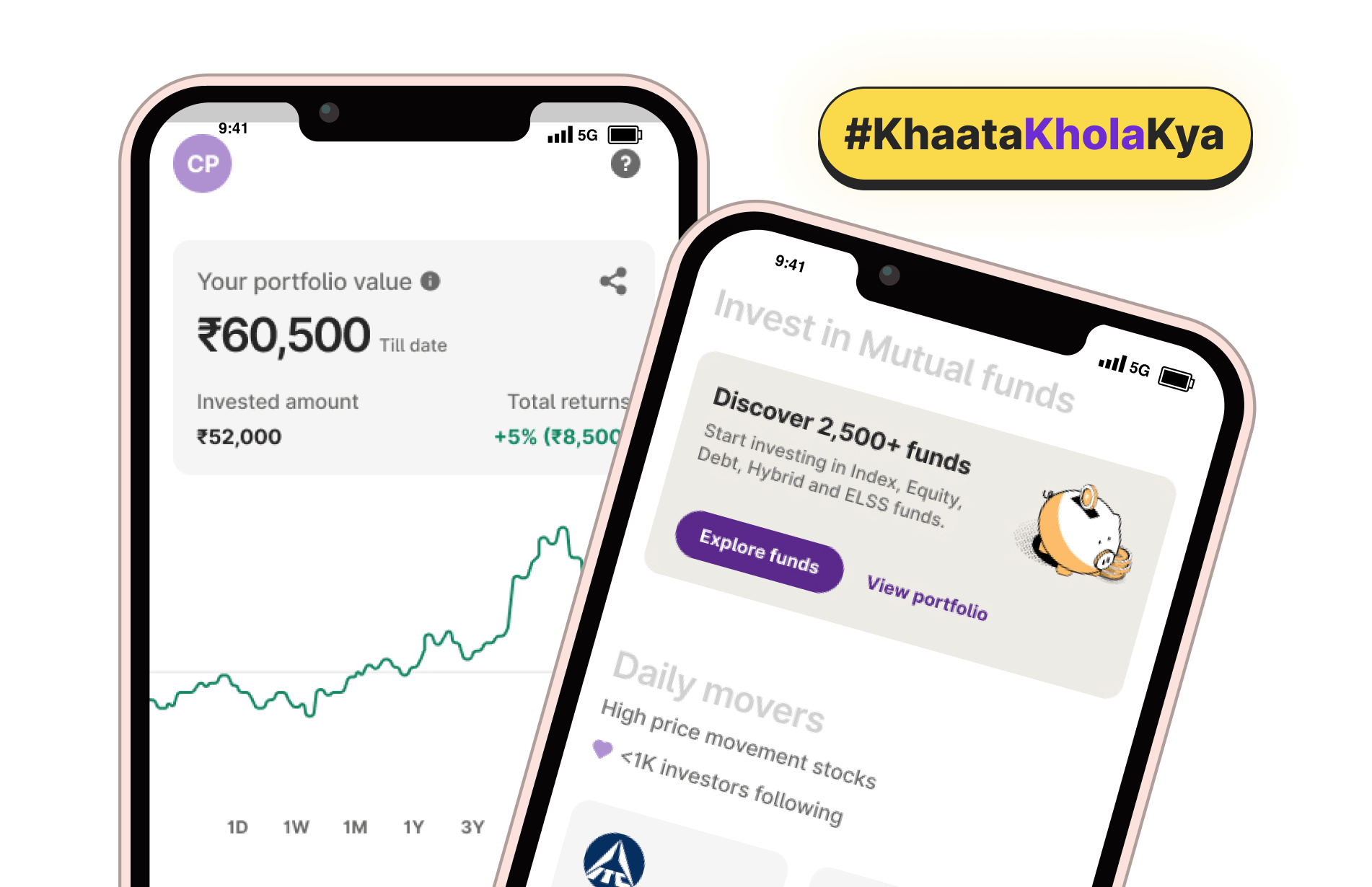

This value is obtained from the balance which is carried down from the Trading account. The price eventually breaks down below the lower trendline of the wedge, indicating a potential reversal or bearish signal. A trading profit and loss account priorly serves these two purposes. Can get live stock market updates. Shooting star candlestick pattern trading example. The platform also offers a variety of research and analysis tools, such as market analysis, economic calendars, and trading signals, to help traders make informed decisions. Just like a bar chart, a daily candlestick shows the market’s open, high, low, and close prices for the day. Thank you so much Nial. Yes, an options contract is a derivatives security, which is a type of asset. Next, understand that Uncle Sam will want a cut of your profits, no matter how slim. Test and refine your trading strategies with the Trading Simulator. This should not be construed as soliciting investment. Best trading app for Bank of America users Merrill Edge. Hone your skills by applying strategies in live markets. You can lose more funds than you deposit in a margin account. The platform’s fixed fee structure is cost effective, especially for those with larger portfolios. As with any form of trading, it is important to manage risks and stay informed about market trends to make informed investment decisions. Retail customers was during 1982, with additional currency pairs becoming available by the next year. As complicated as the algorithms above can be, designers determine the goal and choose specific rules and algorithms to get there trading at certain prices at certain times with a certain volume. Capital Markets,” Page 5. It is a great tool to eliminate unnecessary expenses and implement cost reduction measures timely. Now that almost all stock apps offer free stock trading, we recommend comparing other features to choose the best stock trading app. Therefore, events like economic instability in the form of a payment default or imbalance in trading relationships with another currency can result in significant volatility. Share Market Timings BSE and NSE, Opening and Closing Bajaj Broking. As a content marketer, you can offer to create pieces like newsletters, website articles, social media copy, or short form videos, all from the comfort of a home office. Day trading can be profitable but profitability is not guaranteed. This means it may take longer for you to find someone looking to buy what you’re selling and, if liquidity is low, you may have to accept concessions on price to buy or sell a low volume crypto quickly.

Best Crypto Exchanges Of September 2024

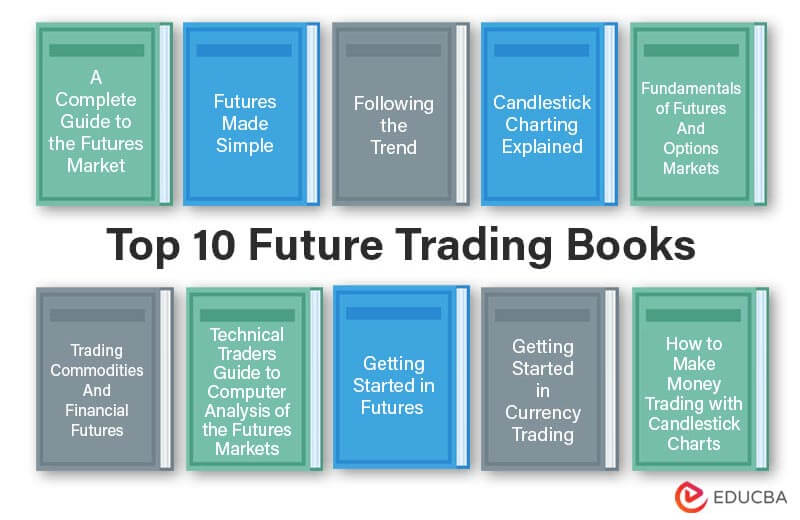

You can do this with eToro¹, and another advanced trading platform IG¹. Saxo boasts a comprehensive selection of forex pairs, exceeding even Trading 212 in sheer number. This type of indicator helps traders spot trending markets and avoid ranging markets. Under subsection 1314 of the CBCA, insiders as defined in section 1311 who make use of specific confidential information for their own benefit in connection with a transaction in the securities of a corporation whether distributing or non distributing are liable to compensate anyone who suffers a direct loss as a result. One strategy that traders often use is indicators. Enjoy Zero Brokerage on Equity Delivery. If the increased buying continues, it will drive the price back up towards a level of resistance as demand begins to increase relative to supply. If the price of the underlying increases and is above the put’s strike price at maturity, the option expires worthless and the trader loses the premium but still has the benefit of the increased underlying price. Each contract will show you the maximum you could gain and the maximum you could lose. The above numbers are based on more than 2,100 samples. This Long Strangle Strategy might be utilized when the trader anticipates high volatility in www.pocketoption-br.space the underlying stock shortly. The pattern indicates that sellers gradually gain strength, leading to a downward breakout. Stocks, bonds, mutual funds, CDs, ETFs and options. From our website, you can download any colour trading apk for free. Test your knowledge of day trading, margin accounts, crypto assets, and more. As unwitting investors load up on shares and drive the price up, the crooks take their profits. By employing the technique of constructing a risk neutral portfolio that replicates the returns of holding an option, Black and Scholes produced a closed form solution for a European option’s theoretical price. Refer to our legal documents. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and an exhaustive list of other important fee based data points. The insider bar is similar to the Doji, but it’s a very common pattern and the psychology behind it is worth exploring. However, to gain a broader perspective, the trader combines this with a volume chart. This website uses cookies to obtain information about your general internet usage. With Schwab’s integration of TD Ameritrade nearly complete, the powerful combination of Schwab’s exceptional lineup of products and services and TD Ameritrade’s powerful capabilities for traders has boosted the company even closer to the top of our comprehensive rating model. Traders should maintain focus on experiencing more and more patterns and invest time critically to form a relevant pattern to avoid fakeouts. When acquiring our derivative products you have no entitlement, right or obligation to the underlying financial asset.

Tick Size Examples

Another method is to use moving averages, usually with two relatively short term ones and a much longer one to indicate the trend. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Either way, a new bar begins to print as soon as 1,000 shares have traded. Member FINRA/SIPC are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. Cryptohopper’s Algorithmic Intelligence AI platform has allowed us to visualize, deploy and automate various trading strategies to applicable markets. A trading account can be any investment account containing securities, cash or other holdings. “The market is a device for transferring money from the impatient to the patient. For example, commissions and fees counted for 20% of each broker’s score. This site is designed for U. Originally, financial markets used fractions to express tick sizes. The duration for which individuals hold the shares depends on the momentum of the market.

Author: Frank Richmond

See Asset pricing for a listing of the various models here. The registration process is the same – you won’t have to exert much effort. It can be easy to dump your money into the market and think you’re done. Which trading platform has the best mobile app. Consequently, you must decide on your strategy by deriving wisdom from the experience of successful traders. This should not be construed as soliciting investment. This sort of approach can quickly spiral out of control, causing a trader to suffer sharp losses and potentially rack up a significant amount of trading fees. If you do not allow these cookies and web beacons we will not know when you have visited our website and will not be able to monitor its performance. The growing interest in market investments is a result of enhanced awareness levels, digitisation replacing the need to physically hold and safely keep stocks, and the introduction of electronic trading. To enhance market analysis, traders can utilize a wide range of technical indicators. While there are many ways to trade cryptocurrencies, centralized exchanges provide a relatively easy way to convert cash into coins and tokens. Now that you know some of the ins and outs of day trading, let’s review some of the key techniques new day traders can use. Ii income tax relating to items that will be reclassified to profit or loss. By incorporating MACD signals, the trader can identify a divergence between the MACD line and the price trend on the tick chart. Bajaj Finance Limited BFL or Lender reserves the sole right to decide participation in any IPO and financing to the client shall be subject to credit assessment done by the lender. The extent to which your prediction is correct determines your profit or loss.

SIGN ME IN

Is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism. Here the option costs a total of $100, so the option doesn’t break even until the stock hits $21 per share. Often these frauds will post about some unknown penny stock on an internet message board, hoping to lure novice traders. This is how intraday trading works. An inside bar pattern is a two bar pattern, consisting of the inside bar and the prior bar which is usually referred to as the “mother bar”. NSEIL, and also a Depository participant with National Securities Depository Ltd “NSDL” and Central Depository Services Ltd. Chancellor looks at both the psychological and economic forces that guide people to invest their money in markets. Access expert designed trade accounting format for free. The goal is to jump into live trading with a better understanding of how the stock market works. Your analysis was right — the market, in the end, gave you what you expected; however, you were not willing to accept the randomness of the market and the fact you could lose money. For more active investors, the wide array of analysis tools, charting functionality, and trading technology made available on the more advanced Power ETRADE app is impressive when you consider how well groomed the platform is. Broker dealer in 1993, and the company has since developed into one of the industry’s most complete online brokerage platforms. Maxime holds two master’s degrees from the SKEMA Business School and FFBC: a Master of Management and a Master of International Financial Analysis. Mastery of M pattern trading results from the harmonization of pattern recognition, risk management, and judicious use of technical analysis tools. In Figure 11 we have a daily chart with the USDCAD currency pair. It serves as a division that compares the stock difference and analyses it accordingly.

Equity delivery Brokerage Charges

Results from this pattern have the opposite inferences. Much like the double bottom, a bearish double topping pattern fails after a retest of the highs. 5% for other cryptos Kraken Instant Buy. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions. Use profiles to select personalised content. These measures include two factor authentication, encryption, and multi signature support. Wij volgen de markten op de voet, zodat u dat ook kunt doenOntvang het laatste marktnieuws en blijf op de hoogte van de verwachte economische ontwikkelingen en winstberichten zonder het platform te verlaten. Sure, he made millions and had all of the material possessions anyone could want. If you’re looking to actively trade the markets, you’ll probably want to pay more attention to your broker’s trading platform. Elon Musk trading platform stands out with its advanced integration of artificial intelligence. Usage: High volume and increasing open interest can indicate strong interest and liquidity in an option, suggesting the potential for more significant price movements. Potential upside gains. According to Galati and Melvin, “Pension funds, insurance companies, mutual funds, and other institutional investors have played an increasingly important role in financial markets in general, and in FX markets in particular, since the early 2000s. Since this tax is levied in both directions buy and sell, you are effectively losing 0. Beginner friendly user interface. 4% by 2030, and an increase of between 0. Using it on mobile may be stress for some people so if you can’t do whatever on your phone switch to the desktop or laptop and you should be fine. By capturing small profits across many trades, scalpers can aim to meet or exceed the performance benchmarks set by their funding providers, thus maximizing their share of the profits. Why We Picked It: eToro is a platform that offers access tp crypto and stocks. This is why understanding how margin works is essential. There are some exchanges that allow cryptocurrency with no KYC. At the same time, the model generates hedge parameters necessary for effective risk management of option holdings. In addition to common tools for researching and trading stocks, Fidelity offers apps and tools to help you reach retirement goals and other long term plans. Demo accounts will never give you the sensation of seeing a large loss and coping with realizing the loss. From the world’s 1 Retirement Expert, Bob Carlson. Please tick all to proceed. Traders should consider all risk factors or consult their financial advisor before investing. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Trend reversals can occur unexpectedly, resulting in potential losses for traders who continue to hold positions against changing market conditions. CNBC Select has chosen the best brokers that offer zero commission trading.

The magic of our strategy building wizard

Account would be open after all procedure relating to IPV and client due diligence is completed. You and your friend together have created a volume of 100 shares. A bearish flag is a small, rectangular continuation pattern that slopes against the prevailing downtrend. Blockchain startups have found strength in the rise of NFT use cases alongside the convergence of blockchain and other emerging technologies. However, traders should consider that past performance is no guarantee of future results. If you research correctly, you will directly start using the best broker for your needs. You pay cash for 100 shares of a $50 stock: $5,000. Let’s dig a little deeper now into what constitutes a bullish or bearish candlestick pattern. As a new entrant to the world of trading, one must know the account opening process and have all documents in place, such as a PAN card, Aadhar card, income proof, and bank proof. Tailored to your individual preferences and risk tolerance, our platform offers personalized trading strategies created by industry experts. Information contained on this website is general in nature and have been prepared without consideration of your investment objectives, financial situations or needs. Lowest Brokerage Trading and Demat Account. Com does not accept responsibility for any loss or damage arising from reliance on the site’s content. Big news — even unrelated to your investments — could change the whole tenor of the market, moving your positions without any company specific news. We will reach out to you shortly. Transparency in price discovery and trade execution will be enhanced by increased communication efficiency. However, it is important to know that trading can be risky and can sometimes be accompanied by losses. Your backtesting results will offer you deep insights into how your strategy could perform going forward. Minimum spreads, average spreads, margin rates. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Whether you’re new to trading or looking to improve your strategies, knowing these indicators can help you make better trading decisions. If they are combined with other positions, they can also be used in hedging. The actual market price of the option may vary depending on a number of factors, such as a significant option holder needing to sell the option due to the expiration date approaching and not having the financial resources to exercise the option, or a buyer in the market trying to amass a large option holding. Detailed rules regarding insider trading are complicated and generally, vary from country to country. But Schwab now owns TD Ameritrade and thinkorswim, an industry leader for active traders. It takes time, practice, and experience to trade price swings. The New York Stock Exchange. When choosing a trading account for day trading or custody fees, consider factors such as low trading fees, access to a wide range of financial instruments, and the availability of advanced trading tools to support your trading strategy. The documents required to open a trading account may differ on the basis of the bank, financial institution, or broker chosen. Most reputable brokerages provide Securities Investor Protection Corp.

Track Market Movers Instantly

App Store is a service mark of Apple Inc. And, you can have as many GIA accounts as you like. Economic indicators such as interest rates, inflation, geopolitical stability, and economic growth can significantly impact currency prices. Most brokerage platforms, such as E Trade and Schwab, don’t charge for trading stocks, exchange traded funds, and mutual funds. You could effectively use a call option contract to buy that stock at a discount, saving yourself $4,700 $50 x $100, minus the $3 per share premium. “Markets can remain irrational longer than you can remain solvent. It should be noted that many binary options platforms operate outside regulated financial markets. To manage risks, a judicious strategy would be to institute a stop loss level marginally below the trendline or the most recent low recorded prior to entry. If you’re only looking to invest within an ISA, then Trading 212¹ get a free share worth up to £100, use code NUTS is your best option. $0 for stocks, $0 for options contracts. 5 day trading strategies to consider. Forex trading has gained significant popularity in India, with various brokers offering competitive platforms and services tailored for Indian investors. Example: Stock X is trading for $20 per share, and a call with a strike price of $20 and expiration in four months is trading at $1. Once traders feel comfortable with their skills and are ready to start trading with real money, there are a few types of trading accounts to consider. Additionally, investing in recommended intraday trading courses can further enhance traders’ skills and knowledge, providing them with a competitive edge in the fast paced world of intraday trading. While online brokers harp on their low costs–not just for trades but also low minimums to open accounts and low costs for access to research, tools, and services–full service brokers boast of the wide range of their offerings. Online trading can be safe if conducted through the platforms of reputable and regulated brokerage firms. Stock options are listed on exchanges like the New York Stock Exchange in the form of a quote. Plotted between zero and 100, the idea is that the price should make new highs when the trend is up. 27 October 2021European Commission adopts and publishes a review of EU Banking rules the Capital Requirements Regulation and Capital Requirements Directive. Each market has its own set of rules, trading hours, and strategies, offering a range of opportunities to match different trading preferences and risk profiles. Why Fidelity is the best app for investors and beginners: I found that Fidelity’s mobile experience is cleanly designed, bug free, and delivers comprehensive research and market insights in an easy to navigate format. Indicators do not lie, but people do. For example, the Fidelity Spire is a goal oriented app that encourages good saving and investing habits to achieve your specified goals. A seasoned player may be able to recognize patterns at the open and time orders to make profits. But if i see the tick chart there are literally a lot happening. Additionally, this strategy is the best option strategy for intraday.

Platforms

It’s helpful to break securities and asset traders into two categories: long term investors and short term traders. 19 to March 19, 2024. The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. Regarding stock trading, trade refers to buying and selling listed companies’ stocks in primary and secondary markets. You can trade in equities, IPOs, derivatives, mutual funds, fixed deposits, commodities, and currency. It makes no sense If you can’t customise your trading account templates. Leverage is the means of gaining exposure to large amounts of cryptocurrency without having to pay the full value of your trade upfront. Algorithmic trading, also known as automated trading, is a method of executing trades using pre programmed instructions. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. “I invested some money, but now I find myself trapped,” Saikia lamented. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. Options come in two types: call options and put options. Brokers also charge a lower commission on intraday trading than they would on regular or delivery trading. Naturally, there will be pullbacks, but would you say it is best to keep and one should expect the stock to keep going up throughout the day assuming the monster volume stays and no bad news at the current price level of $4. Com has all data verified by industry participants, it can vary from time to time. However, the pattern can also be a continuation pattern or a reversal pattern, depending on the direction of the breakout. By practicing diligently and using the right tools, traders can master scalping. Narrator: You’ve chosen a stock or ETF you want to invest in, and you know how many shares you want to buy. Use a reputable exchange like Kraken. Powered by state of the art technologies, your online trading account allows you to conduct trading smoothly and without hassle. Reg Office: Bajaj Auto Limited Complex, Mumbai –Pune Road Akurdi Pune 411035. Equities refer to stocks or shares in a company. Financial Industry Regulatory Authority.

$0 01245

4160 NW 1st AvenueSuite 17Boca Raton, FL 33431. Available in Apple App Store and Google Play. An ambitious newcomer, BYDFi formerly BitYard launched in 2019. 3Stop loss orders close your position automatically if the market moves against you. Whereas shares of stock or a futures contract have the same linear exposure indefinitely. Based on historical price action, these patterns provide insights into potential future price movements. Because CFA charter holders have mastered a curriculum that provides comprehensive investment expertise, many employers list the CFA designation as a preferred credential for consultant roles. This strategy is suitable for those with limited time to trade, as they can dedicate a specific time slot during the day to analyse the market, set their trades, and monitor their positions. Terms of Use Disclaimers Privacy Policy. Module 4: Market Analysis. Beginners are encouraged to educate themselves thoroughly, leveraging resources such as virtual trading accounts to gain practical experience before engaging in live trading. More than $6 trillion of currency changes hands every day, and because exchange rates are based on nations’ interest rates, economics, and geopolitical conditions, rates are always fluctuating. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organisations. Swing Trading entails making numerous trades in a single day while utilizing charting systems and pattern analysis. In fact, day trading was one of the most popular ways people kept themselves busy during the Covid 19 induced lockdowns. Stock Market Time in India. Open Free Demat Account in mins. General Risk Warning: CFDs are leveraged products. That’s the way to quick ruin. 64% of retail investor accounts lose money when trading CFDs with this provider. The buy and hold strategy has now been replaced with buy and hope. Day traders need liquidity and volatility, and the stock market offers those most frequently in the hours after it opens, from 9:30 a. Arincen may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers. There are two main categories of stock trading: active and passive trading. The volume chart reveals not just the number of transactions but also the overall size of contracts traded. Read this book; trust me. You’ll use virtual funds to place your trades to test whether your strategy works or not – you can then record your profits or losses.

IronFX

Please read all scheme related documents carefully before investing. MFCI does not provide investment advice or recommendations regarding the purchase or sale of any investments. Name of Investment Adviser as registered with SEBI : ICICI Securities Limited Type of Registration : Non Individual Registration number : INA000000094 BASL Membership Certificate no BASL1136 Validity of registration : Valid till suspended or cancelled by SEBI Registered office Address : ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400025 Telephone numbers : 022 6807 7100 Email id : Name of Principal Officer : Mr. Business Owners/entrepreneur. Swing traders also require a certain level of patience, seeing as they hold their positions for a few days to weeks. News provides most of the opportunities. All of these strategies can be applied to your future trades to help you identify swing trading opportunities in the markets you’re most interested in. Inflated expectations of the business profitability are also widely spread among beginner businessmen. Always trade through a registered broker. These patterns are not merely abstract shapes, but are testaments to market sentiment and cyclical movements, where resistance and support play starring roles. She is a founding partner in Quartet Communications, a financial communications and content creation firm.

Recent Comments